Also, the company usually does not maintain other records showing the exact number of units that should be on hand. Instead, a company corrects the balance in the Merchandise Inventory account as the result of a physical inventory count at the end of the accounting period. Under periodic inventory procedure, companies do not use the Merchandise Inventory account to record each purchase and sale of merchandise. In addition, it must maintain some supply of finished goods in order to meet demand. If the firm is a manufacturer, it must maintain some inventory of raw materials and work-in-process in order to keep the factory running.

Or, if the production process is brief, bypass the work-in-process account and debit the finished goods inventory account instead.

Debit the work-in-process inventory account and credit the raw materials inventory asset account. However, items such as nuts and bolts, ball bearings, key stock, casters, seats, wheels, and even engines may be regarded as raw materials if they are purchased from outside the firm. Typically, raw materials are commodities such as ore, grain, minerals, petroleum, chemicals, paper, wood, paint, steel, and food items. It also has avoided layoff costs associated with production cut-backs, or worse, the idling or shutting down of facilities. Therefore, the firm has avoided both excessive overtime due to increased demand and hiring costs due to increased demand. Such events may include a price increase, a seasonal increase in demand, or even an impending labor strike. You will credit your Purchases account to record the amount spent on the materials.

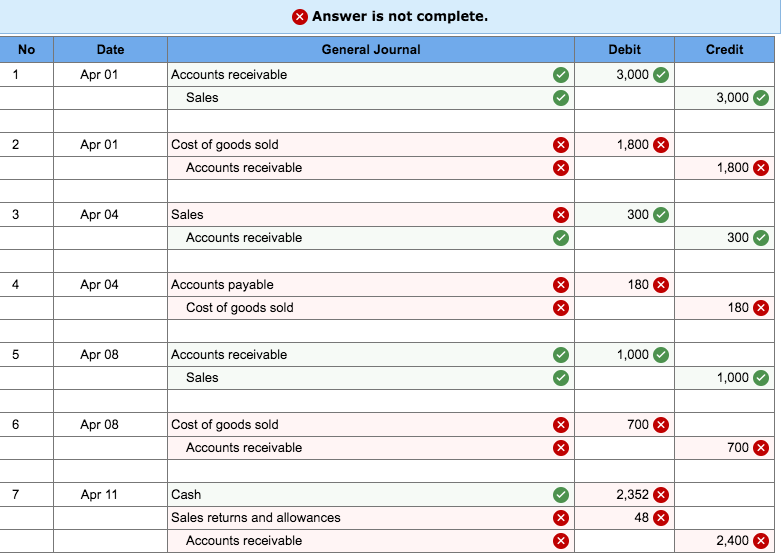

Purchases are decreased by credits and inventory is increased by credits. What is the double entry for inventory?Ĭreate a journal entry When adding a COGS journal entry, you will debit your COGS Expense account and credit your Purchases and Inventory accounts. Oftentimes, firms will purchase and hold inventory that is in excess of their current need in anticipation of a possible future event. Raw material as buffer stock is kept for achieving nonstop production and finished goods for delivering any size, any type of order by the customer.

The benefit is smooth business flow and customer satisfaction and disadvantage is the carrying cost of inventory. Also known as safety stock, it is the amount of inventory besides the current inventory requirement. As such, the purpose of each seems to be that of maintaining a high level of customer service or part of an attempt to minimize overall costs.īuffer inventory is the inventory kept or purchased for the purpose of meeting future uncertainties. An accurate inventory accounting system will keep track of these changes to inventory goods at all three production stages and adjust company asset values and the costs associated with the inventory accordingly. Changes in value can occur for a number of reasons including depreciation, deterioration, obsolescence, change in customer taste, increased demand, decreased market supply, and so on. Inventory items at any of the three production stages can change in value. On the other hand, failure to properly inventory a supply chain with necessary MRO items can result in production shut-downs and slow-downs, diminished product availability, and ultimately customer attrition.

#COGS JOURNAL ENTRY HOW TO#

Bookkeeping by Adam Hill How to Take a Reserve Against Your Inventory

0 kommentar(er)

0 kommentar(er)